This text was last amended on 28 April 2023

On 20 July 2022, the Bpf Koopvaardij board decided to grant an extra supplement to your pension. As of 1 January 2023, Bpf Koopvaardij will increase your pension by 0.84%.

Why is Bpf Koopvaardij increasing your pension?

As of 1 January 2022, Bpf Koopvaardij increased your pension by 0.44%. However, the government has recently relaxed the rules for granting supplements. By doing so, the government is anticipating the new rules for pensions under the Dutch Future of Pensions Act (Wet Toekomst Pensioenen). Pension funds may temporarily calculate using a lower limit when granting supplements. This means that an additional supplement is possible. Bpf Koopvaardij is now using this statutory possibility.

How was the percentage of 0.84% calculated?

When deciding on the extra supplements, Bpf Koopvaardij considered two issues:

1. Which period is leading for the granting of supplements?

Bpf Koopvaardij aims to have your pension increase partly in line with the cost of living in a certain period. The period in question is laid down in the pension regulations. For the granting of supplements as of 1 January 2022, Bpf Koopvaardij examined the increase in the cost of living in the period from 1 July 2020 up to and including 30 June 2021. The increase was 1.29%.

2. How much supplement has already been granted?

In January 2022, Bpf Koopvaardij increased your pension by 0.44%. The additional supplementation as of 1 January 2023 of 0.84% compensates the full price increase of 1.29%. This may seem a strange addition. However, the percentage is slightly lower, because Bpf Koopvaardij now calculates this supplement on the previously granted supplement of 0.44%. In total, the result is the same. You have therefore received this 1.29% in two steps.

In late 2022, Bpf Koopvaardij will decide on granting supplements in 2023

Prices have risen sharply in recent months. In November 2022, Bpf Koopvaardij will decide whether this will lead to a new supplementation as of 1 January 2023. For this purpose, Bpf Koopvaardij will consider:

- the increase in the cost of living from 1 July 2021 up to and including 30 June 2022;

- financial situation of Bpf Koopvaardij; and

- the applicable statutory regulations at that time.

When will you notice the effects of this supplementation on your pension?

Bpf Koopvaardij will process the supplementation of 0.84% as of 1 January 2023 in your build-up pension or in your pension benefits. If the board decides in November 2022 to grant a supplement related to the increase in the cost of living between 1 July 2021 and 30 June 2022, this supplement will also lead to an increase in your built-up pension or in your pension benefits as of 1 January 2023. The supplements will then be added together.

You will receive a letter after Bpf Koopvaardij has taken a decision in November 2022 about the possible granting of supplements as of 1 January 2023. This letter will provide a further explanation about the extra supplementation and the possible new supplementation as of 1 January 2023.

Further explanation

The fact that we were allowed to increase pensions is obviously good news, but we remain critical. Is it fair, to both young and old? Aren't we harming any people? We show how we examined that issue.

For years now, pensions have not increased or only partially increased. Everyone who receives a pension felt it in their pockets. With pensions increasing, they will notice it immediately. Their purchasing power improves a little. Those who are not yet receiving a pension will not notice the impact immediately. Of course, in the short term, they see that their pensions they will be receiving in the future will increase because of the supplementation. But increasing all pensions does mean that our funding ratio will fall. And that also has implications for longer-term pension performance. The pension performance indicates the extent to which we have factored in price increases in your pension and therefore whether purchasing power is maintained.

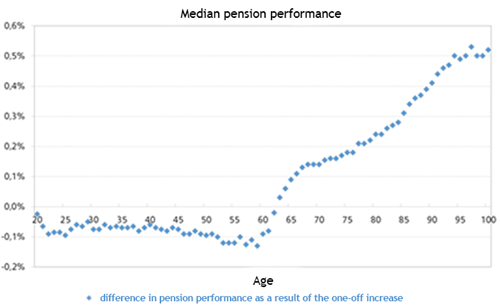

We have calculated the long-term effect of the increase we are granting now. The graph below shows the difference in pension performance for different ages as a result of the 0.84% increase.

What do you see in this graph?

A pension fund can spend its money only once. If we grant an extra supplement now, not everyone can gain. Older people will gain a maximum of about 0.5%, and young people will lose about 0.1%:

- The increase for those up to around the age of 62 has a small negative impact on the pension performance. We are now using some of the assets in order to be able to grant the increase. So we therefore have fewer assets to help pay for the pensions of these persons in the future. But a large proportion of these individuals will still be building up pension for a long time. That pension is not impacted by this decision. Therefore, the final effect is only slight.

- The situation for those over the age of 62 will now improve a little more. This is mainly because the increase gives them an immediate higher pension. Their purchasing power will improve directly as a result.

New pension scheme

The Dutch Future Pensions Act also means a new pension scheme for Bpf Koopvaardij. It will be several years before the new scheme starts. But we already take into account that there may be differences. The pension people can expect in the current scheme may be different from the pension people are expected to get in the new scheme.

The board has considered the implications of a supplement being granted now. Does this affect possible choices or actions you take later? Every euro we spend now by increasing pensions cannot be used later to compensate certain groups if needed, nor to establish a reserve to absorb large fluctuations in the expected pension.

Balanced decision

The board carefully weighed all interests (of active members, former members and pensioners) when deciding to grant an additional supplement. The board looked at the purchasing power of pensioners, the pension performance for all, as well as the possible details of the new pension scheme. Pensioners have faced a drop in purchasing power in recent years and will benefit from the additional supplement. Granting this supplement has only a negative effect of about 0.1% for active members and former members. Supplementation now – given the financial health of the fund – does not seem to preclude a satisfactory transition to the new pension scheme in the future. The Bpf Koopvaardij board considers it justified to decide that pensions can be increased by an additional 0.84% from 1 January 2023.