This text was last amended on 12 May 2023

Bpf Koopvaardij tries to increase your pension each year with a supplement. The aim of this supplement is to increase the pensions to some extent in line with the cost of living. To do so, we look at price increases over the past year. In this news item, we explain more about this indexation.

Your pension will increase by 10.84% with effect from 1 January 2023

The increase consists of two components:

- An additional supplement of 0.84%

- A 10% supplement

Below, we explain both supplements:

re 1) An additional supplement of 0.84%

On 20 July 2022, the board of Bpf Koopvaardij decided to grant an additional supplement of 0.84%. That supplement will be implemented with effect from 1 January 2023. This is on top of the 0.44% supplement that was already allocated with effect from 1 January 2022. You can read more about it in the news item of 21 July 2022.

re 2) A supplement of 10%

You will receive a supplement of 10% as of 1 January 2023. Annually, Bpf Koopvaardij decides on granting supplements. For the supplement from 1 January 2023, we look at the increase in the consumer price index over the period from July 2021 to July 2022. That increase was 12.44%. In principle, the pension fund wants to grant 50% of this increase as a supplement. Based on the normal supplement policy, Bpf Koopvaardij could have granted a supplement of 4.2%. In 2022, however, the government relaxed the rules for granting supplements. By doing so, the government is anticipating the new rules for pensions under the Dutch Future Pensions Act (Wet toekomst pensioenen). Pension funds are allowed to temporarily grant a supplement in the case of a lower funding ratio than before. This means that an additional supplement is possible. Bpf Koopvaardij is using this statutory possibility. That is why it has decided to increase the pensions by 10% as of 1 January 2023. This percentage consists of:

- the normal supplement of 4.2% according to the supplement policy, as well as

- an additional supplement of 5.8%.

Bpf Koopvaardij may grant the extra supplement of 5.8% only if it explains a number of components. Below, we list and explain the components.

a) Bpf Koopvaardij expects that the pension entitlements and rights built up will soon be ‘converted’

Employer and employee organisations in the merchant navy sector (i.e. social partners) are jointly studying the new scheme. One part of the new scheme is a decision on the conversion of the pensions. By conversion we mean transferring pensions to the new pension scheme. The study is ongoing, but social partners have not yet taken final decisions. It is neither necessary nor possible at present, as the legislation is not yet final.

Bpf Koopvaardij is now allowed to grant the extra supplement only if it expects pensions to be converted, and for that they need to know the viewpoint of the social partners. They recently revealed that they consider the option of conversion to be a realistic option. They will take the final decision regarding this matter at a later date.

Bpf Koopvaardij then conducted its own review of whether conversion was in the best interests of all those entitled to pensions. Bpf Koopvaardij sees no reason to deviate from the expectation of the social partners. Accordingly, Bpf Koopvaardij expects pensions to be converted at the start of the new pension scheme.

b) The extra supplements are granted in the interests of all members, former members and pensioners

Bpf Koopvaardij considered at length whether all interests had been properly considered. Is it fair, to both young and old? Can we be sure that everyone will benefit? For years now, pensions have not increased or only partially increased. Everyone who receives a pension felt it in their pockets. With pensions increasing, they will notice it immediately. Their purchasing power improves. The board carefully weighed all interests when deciding to grant an additional supplement. The board considered:

- the purchasing power of pensioners,

- the pension performance for all; and

- the possible details of the new pension scheme.

Pensioners have faced a drop in purchasing power in recent years. They therefore benefit from the additional supplement. Granting this supplement has a negative effect of no more than about 0.5% for some of the active members and former members. Supplementation now – given the financial health of the fund – does not seem to preclude a satisfactory transition to the new pension scheme in the future.

c) Bpf Koopvaardij has looked in detail at the impact of the additional supplement on different generations

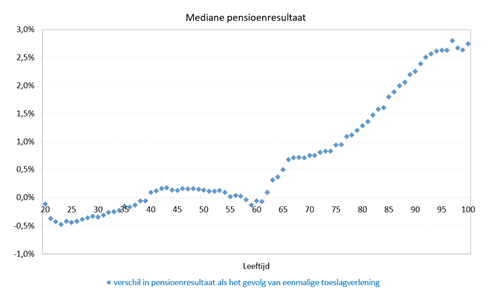

We have calculated the long-term effect of the increase we are granting now. The graph below shows the pension performance for the various age groups. We show the pension performance resulting from the additional 5.8% increase.

What do you see in this graph?

A pension fund can spend its money only once. If we grant a supplement now, not everyone can gain. Older people will gain a maximum of about 2.5%, and younger people will lose a maximum of about 0.5%:

- The increase for those up to around the age of 35 has a small negative impact on the pension performance. We are now using some of the assets in order to be able to grant the increase. So we therefore have fewer assets to help pay for the pensions of these persons in the future. But a large proportion of these individuals will still be building up pension for a long time. That pension is not impacted by this decision. Therefore, the final effect is only slight.

- For those aged between 35 and 60, the increase has a small positive impact. They have already built up a larger portion of their pension than younger people. That pension is immediately higher as a result of the increase. But they too will continue to build up pension for some time. That pension will not impacted by the increase. Therefore, the effect is smaller than for people above the age of 60.

- The situation for those over the age of 60 will now improve a little more. This is mainly because the increase gives them an immediate higher pension. Their purchasing power will improve directly as a result.

Balanced decision

The board carefully weighed all interests (of active members, former members and pensioners) when deciding to grant a supplement. The board considered:

- the purchasing power of pensioners,

- the pension performance for everyone and

- the possible details of the new pension scheme.

Pensioners benefit the most. They have faced a drop in purchasing power in recent years. They therefore benefit from the additional 5.8% supplement. Granting this supplement has a negative effect of no more than about 0.5% for the youngest active and former members. It has a positive effect of up to about 2.5% for slightly older active and former members.

Supplementation now – given the financial health of the fund – does not seem to preclude a satisfactory transition to the new pension scheme in the future. However, the board does want to keep Bpf Koopvaardij's financial situation sufficiently robust. Therefore, the board considers it more balanced not to increase pensions by the full increase in the consumer price index. The Bpf Koopvaardij Board considers it justified to decide that pensions can be increased by an additional 10% from 1 January 2023. This percentage consists of: a supplement according to the supplement policy of 4.2%; and an additional supplement of 5.8%.